By 2025, the market size of modified plastics in China has exceeded 380 billion yuan, and it is expected to rise to 520 billion yuan by 2030. The underlying tone of this growth curve is being profoundly reshaped by the "carbon neutrality" strategy - the EU's CBAM mechanism will cover plastic products, the domestic target of 25 million tons of recycled plastic production capacity has been implemented, and the tightening of low-carbon supply chain terms by leading brands have all exerted multiple pressures. Under these circumstances, "green transformation" is no longer just an environmental slogan; it has become the core competitiveness for seizing 60% of the green production capacity market share. Among them, the breakthroughs in low-carbon materials such as polylactic acid (PLA), in conjunction with the three paths of raw material innovation, circular reconstruction, and manufacturing efficiency improvement, are completely rewriting the rules of industrial competition.

The Raw Material Revolution - PLA Takes the Lead, Ending "Fossil Dependency"

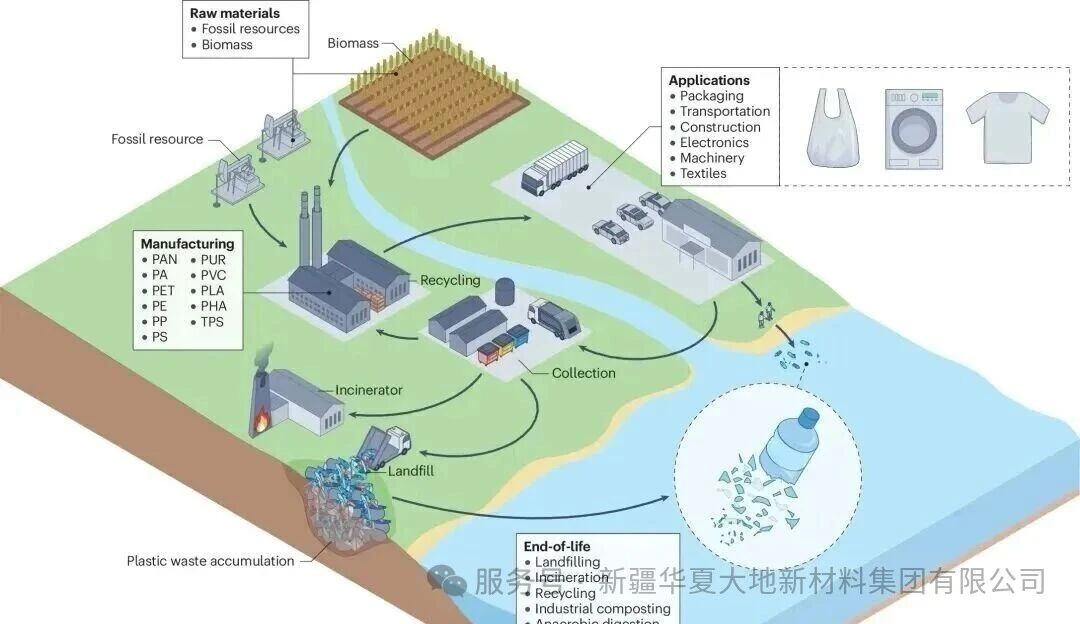

The core of the plastic industry chain is the "carbon chain". With a 99% share of fossil raw materials, it falls into the high-emission sector. Low-carbon raw materials such as PLA are moving from the laboratory to the commercialization battlefield, building a diversified alternative system.

As the core category of biobased materials, PLA is made from biomass such as corn and straw. Its carbon emissions throughout the entire life cycle are reduced by more than 60% compared to traditional plastics, and it has the characteristic of natural degradation, making it an ideal alternative material for packaging, disposable products, and other fields. Currently, the global production capacity of PLA exceeds 15 million tons. Some enterprises have achieved mass production of tens of thousands of tons. Through technologies such as toughening modification and heat resistance modification, the problems of PLA's low-temperature brittleness and low heat deformation temperature have been solved, enabling it to successfully enter scenarios such as tableware and 3D printing consumables. The domestic market size of PLA modified products will exceed 5 billion yuan in 2024, and is expected to reach 12 billion yuan in 2027, with an annual growth rate of over 30%.

Circular Reengineering - From "Disposal After Use" to "Closed-loop Recycling"

The recycling rate of waste plastics in China is only 32%, which is a significant gap from the 55% target set by the European Union. However, this also indicates that a trillion-dollar recycling market remains to be explored. The industry is addressing the problem of "low-end" recycled materials through a dual-drive approach of "physics and chemistry".

Physical recycling for value enhancement has become the direct beneficiary of policy dividends. The "14th Five-Year Plan" Plastic Pollution Control Action Plan promotes the high-end application of recycled materials. Some enterprises have achieved a blending of over 30% recycled materials for PP and PA substrates, reducing the carbon footprint of the products by 40%. Chemical recycling targets the pain points in the processing of complex waste plastics. Although there are some setbacks experienced by certain foreign enterprises, domestic enterprises have controlled the production capacity of each plant within 20,000 tons through modular pyrolysis equipment, reducing investment risks.

Improving manufacturing efficiency - "Low-carbon manufacturing" reduces costs and enhances efficiency

The production process accounts for 28% of the carbon emissions from modified plastics. Energy efficiency upgrades have become the key to reducing costs and increasing efficiency. The dual paths of "energy substitution + process innovation" are making "intelligent manufacturing as low-carbon" a reality.

The green electricity transformation has shown practical results. After the chemical industrial parks in the Yangtze River Delta connected to the green electricity trading system, a leading enterprise reduced its carbon emissions per unit product by 22% by replacing its electric heating extrusion machines with new ones and building its own photovoltaic power station. It also saved over 8 million yuan in carbon costs annually. Based on the current carbon price, an enterprise with an annual production capacity of 100,000 tons could have a carbon cost of 12 million yuan. The energy transition is now urgent.

Demand-driven - Emerging downstream sectors open up growth opportunities

The green transformation of modified plastics has always been in sync with the upgrading of downstream demands. In 2024, China's production of modified plastics reached 33.2 million tons, increasing by 11.6%. This growth was mainly driven by emerging fields such as new energy vehicles, high-end home appliances, and 5G communications. In the field of new energy vehicles, the demand for battery pack components for high flame-retardant and high heat-resistant modified plastics has soared. PLA-based composite modified materials, by adding nano flame-retardants, have achieved UL94 V-0 level flame-retardant effect and have been successfully applied to low-voltage wiring sheaths; under the trend of high-endization of home appliances, recycled PCR modified materials, due to their low-carbon advantages, have become the preferred materials for some enterprises' refrigerator inner linings and washing machine panels.

Technological Breakthrough - Innovative Key Additives Solve Performance Limitations

The performance improvement of modified plastics cannot be achieved without the technological breakthrough of core additives. This field is becoming an important support for the green transformation. A certain enterprise independently developed the "MCA nano-level ultrafine grinding technology", which successfully stabilized the particle size of the flame retardant MCA at the nanometer level, solving the problem of uneven dispersion of traditional additives that affected the mechanical properties of the materials. After applying this technology, the flame retardancy grade of modified plastics significantly improved under the same amount of flame retardant addition, while the toughness and impact resistance increased by 15% - 20%, perfectly meeting the requirements of precise scenarios such as high-voltage connectors for new energy vehicles and 5G equipment shells.

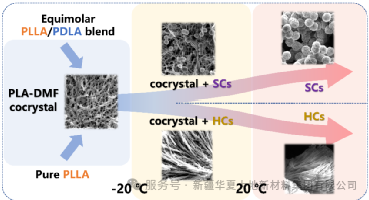

In the field of PLA modification, innovation in additives is equally crucial. Domestic enterprises have developed specialized nucleating agents and toughening agents, which not only increased the thermal deformation temperature of PLA from 60°C to over 120°C, but also extended the product's weather resistance to more than 2 years, breaking the application limitations of PLA in outdoor and high-temperature scenarios. These breakthroughs in additive technology are driving the transformation of modified plastics from "adequate" to "high-quality" and "high-end", paving the way for the commercialization of green materials.

Conclusion: System reconfiguration is necessary to gain the upper hand.

The green transformation of modified plastics is not the victory of a single material or technology. Instead, it is a multi-dimensional co-evolution involving low-carbon raw materials like PLA, recycling systems, intelligent manufacturing processes, downstream demand, and innovation in additives. When biobased materials open the door to the catering industry, when recycled materials enter the field of new energy vehicles, and when nano additives break through performance bottlenecks, these cases all prove that carbon neutrality is not a constraint but a catalyst for industrial upgrading. Currently, the industry still mainly focuses on mid-to-low-end products. Technological breakthroughs and green transformation in the high-end market will become the key for enterprises to break through.

For enterprises, by leveraging the advantages of regional industrial clusters and focusing on distinctive paths such as PLA modification and high-value utilization of recycled materials, they can gain the upper hand in the 520 billion yuan market by 2030. After all, true industry leaders are always the definers of trends rather than followers.