From a technical and engineering perspective, observe and interpret the technological advancements and industrialization issues of chemical products

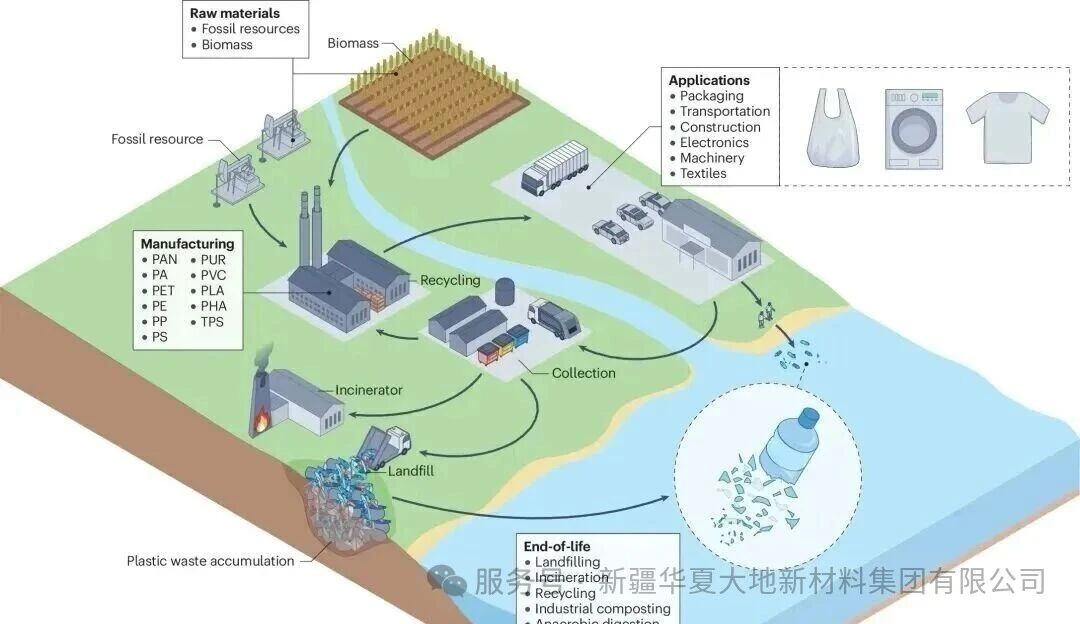

Driven by the "dual carbon" goals, global "plastic ban" regulations, and the national strategy for bio-manufacturing, biobased materials, as a key driver for the transition from the "black economy" to the "green economy", have entered an accelerated development phase. They are moving from concept validation to large-scale substitution and have become the core direction of the green transformation in the chemical industry. According to the European Bioplastics Association, global bioplastic production capacity will increase from approximately 21.8 million tons in 2023 to 74.3 million tons in 2028, with a significant annual compound growth rate. In 2025, China's "14th Five-Year Plan" clearly designated bio-manufacturing as a core area for cultivating new quality productive forces. Under the dual drive of policies and the market, polylactic acid (PLA) and polyhydroxyalkanoates (PHAs), as the most representative materials, are currently at a critical stage of industrialization. This article integrates industry data and enterprise practices to systematically analyze the technical paths, production capacity patterns, enterprise layouts, and deep industry challenges of the two core materials, polylactic acid and polyhydroxyalkanoates, presenting the competitive situation and development trends of the global biobased materials industry.

1. Polylactic Acid (PLA): The leading "main force" in the industrialization process that broke through first

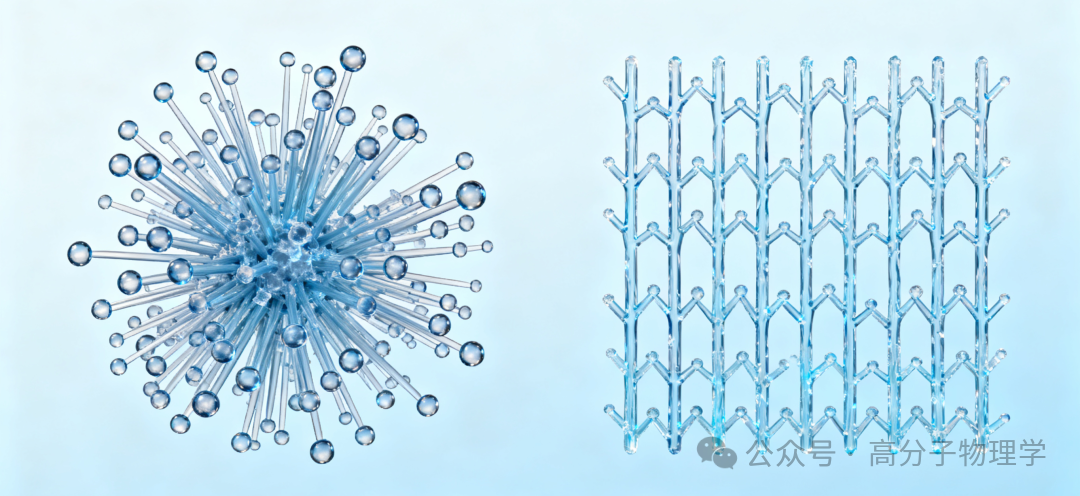

PLA is currently the most industrialized and widely applied biodegradable plastic. Its core advantages lie in excellent transparency, glossiness, and mechanical strength, and it is derived from renewable plant resources such as corn and sugarcane. It has been widely used in packaging, textiles, 3D printing, and medical fields. 1. Technology Route and Core Bottlenecks The synthesis of PLA mainly follows two technical paths: direct polycondensation method: the process is simple but the molecular weight is difficult to increase, resulting in limited product performance and narrow application scope; ring-opening polymerization method (caprolactone route): the current mainstream industrialization route, the core difficulty lies in the synthesis and purification of high-purity caprolactone (Lactide). For a long time, this technology has been monopolized by international giants, becoming a "lethality bottleneck" restricting the large-scale expansion of China's PLA industry. Domestic production has previously relied on imported caprolactone. 2. Capacity Structure and Enterprise Layout According to data from China Commercial Industry Research Institute and Fortune Business Insights, the market size of polylactic acid alone will increase from 1.07 billion US dollars in 2023 to 4.22 billion US dollars in 2032, with a compound annual growth rate (CAGR) of 16.3% (1). Global Capacity Distribution In 2024, China's PLA capacity is approximately 309,000 tons, and the production is expected to exceed 365,000 tons in 2025; currently, the planned and under-construction PLA capacity worldwide is approximately 1.48 million tons, of which nearly 90% (13.1 million tons) is concentrated in China, indicating a clear trend of capacity transfer to China. (2) Enterprise Layout NatureWorks: The world's largest PLA producer, the Nebraska plant in the United States has an annual production capacity of 1.5 million tons, and the 7.5 million-ton/year fully integrated Ingeo™ PLA factory in Thailand is expected to be fully operational in 2025; Tottal Cobion (a joint venture between Total and Cobion): Thailand has a 7.5 million-ton/year capacity, and it is a major market leader globally. (3) Domestic Breakthrough Enterprises Fengyuan Group (BBCA): Successfully overcame the caprolactone technology and built a 10,000-ton PLA production line; Haizheng Shengcai, as the first domestic enterprise to achieve PLA industrialization, has mastered its own technology and has been deeply engaged in modification technology and high-end applications; Jindan Technology (the leading domestic producer of lactic acid, with a 105,000-ton L-lactic acid production capacity) is accelerating its vertical extension to downstream caprolactone and PLA; Wanhua Chemical, with its strong R&D system, has laid out bio-based monomers and polymers and is among the top competitors in the industry.

II. Polyhydroxyalkanoates (PHAs): A Promising "Stock" Enabled by Synthetic Biology

The chemical synthesis pathways of PHAs and PLA are different. PHAs are intracellular polyesters synthesized by microorganisms within cells. The core advantage lies in their excellent biocompatibility and marine natural degradation ability (no need for industrial composting, which PLA does not have), and they have similar barrier properties to PE/PP, with broad application potential. The global market value of PHAs in 2024 is approximately 120 million US dollars. Although the scale is still smaller than PLA, its growth potential is significant. 1. Current technical status and core features Material family composition: Not a single material, including PHB, PHBV, P3HB4HB, PHBH, etc. among various structures. Among them, PHBH (poly(3-hydroxybutyrate-co-3-hydroxyhexanoate)) occupies about 70% of the market share due to its balance of flexibility and impact resistance; Core advantages: Mild degradation conditions, can be completely decomposed in natural environments (including seawater), outstanding biocompatibility; Main pain points: High production costs (more than 2-3 times that of PLA) and poor thermal stability are still the "pain points" restricting its large-scale popularization, the traditional fermentation extraction process is complex, and the current technical research focus is concentrated on the synthetic biology modification of microbial strains and the use of non-food raw materials (waste oil, straw, CO₂) to reduce substrate costs. 2. Industrialization process and enterprise layout (1) International market Danimer Science: Acquired core technology through the acquisition of Meridian Holdings, its products have entered the supply chains of giants such as PepsiCo, and it is a star enterprise in the global PHAs field. (2) Domestic progress Bluepha: Utilizing the technology licensed by Tsinghua University, focuses on the industrialization of P3HB4HB, the 50,000-ton/year PHA production base in Jiangsu Yancheng has been put into operation, with a focus on consumer product packaging and high-end medical materials; Mediphage: Relying on the "Next Generation Industrial Biotechnology (NGIB)" team of Professor Chen Guoqiang from Tsinghua University, explores halophilic bacteria technology to solve the problems of bacterial contamination and high energy consumption, leading in low-cost production and diversified applications; Zhuhai Weide: Focuses on the

III. Deep Driving Forces of the Industry: Policy, Technology and Market Synergy research and production of PHBH, continuously improving yield through synthetic biology means.

From the end of 2025 to the beginning of 2026, the Chinese bio-based materials industry exhibited a notable "policy + market" dual-driven characteristic: 1. Policy support has intensified the forward-looking layout of bio-manufacturing in China's "15th Five-Year Plan" for new materials. Through special support policies, the bottleneck of "preliminary trial transformation" has been overcome. The target is that by 2030, the market size of China's bio-manufacturing will reach 1.8 trillion yuan, accounting for 25% of the global share. The establishment of the EU carbon border adjustment mechanism (CBAM) and domestic carbon footprint accounting standards has transformed the low-carbon attributes of bio-based materials (reducing emissions by 50%-80% compared to petrochemical-based plastics) into a trade competitive advantage. 2. Technological innovation empowers the rapid development of synthetic biology, promoting the improvement of PHAs strains and yield enhancement, breakthroughs in core technologies such as caprolactone purification and non-food raw material conversion, gradually breaking international monopolies, and providing support for industrial scale-down cost reduction. 3. Raw material route transformation to avoid the risk of "competing with the public for food resources", the industry's research and development focus has shifted from food raw materials such as corn and sugarcane to three-generation non-food raw materials such as straw cellulose, waste oils, and carbon dioxide, promoting sustainable industrial development.

IV. Industry Challenges: Multiple Constraints Hindering Large-Scale Development

1. The competition between raw materials and food security: Currently, most bio-based materials still heavily rely on food crops. The enzymatic hydrolysis efficiency and pretreatment costs of non-food raw materials (such as straw) remain fundamental scientific challenges. The transformation towards raw material diversification is still a long and arduous task.

2. Dual constraints of cost and performance: Under the backdrop of fluctuating crude oil prices, bio-based materials have a significant premium compared to common plastics like PP and PE. At the same time, PLA requires industrial composting conditions to degrade, and PHAs have insufficient thermal stability. Both need to be modified through blending (such as with PBAT and PBS) to meet industrial requirements in terms of heat resistance and barrier properties, and their application scenarios are limited.

3. Excess production and the absence of an ecological system: A large influx of capital has led to a phased production surplus and price war risk for general-grade PLA. Additionally, the detection standards for bio-based content and the evaluation system for the ecological safety of degradation products are not yet complete. Moreover, the mixing of biodegradable plastics with traditional recycling streams can cause pollution, and it is urgent to establish an independent end-of-pipe processing loop.

V. Conclusion

The rise of bio-based materials is not merely a simple substitution of petroleum-based materials; it is a comprehensive project involving raw material reconfiguration, process innovation, policy guidance, and changes in consumer concepts. In the short term, technological breakthroughs (such as purification of caprolactone and construction of high-yield strains) are the core for the industry to break through; in the long term, raw material diversification, performance modification upgrades, and the establishment of a closed-loop eco-system for the back-end recycling will determine the competitiveness of the industry. For chemical enterprises, it is recommended to leverage their existing polymerization equipment renovation capabilities and engineering experience, by investing in synthetic biology start-ups or establishing specialized research and development centers, to seize the commanding heights of the material revolution and seize opportunities in the green transformation wave.