On the

packaging bag of a cup of milk tea, the "biodegradable" label is becoming the new code in global trade.

Just half a year after the EU's carbon border tax was officially implemented, the trade volume of bio-based materials has increased by 43% year-on-year. While traditional chemical giants are still struggling with the cost of carbon emissions, a group of astute Chinese enterprises have opened up new growth channels through bio-based materials - this is not only an environmental transformation, but also a life-and-death race for future market share.

I. Policy Hurricane Spawns a Wave of Substitution

Core Driving Force: Carbon Costs Outweigh Traditional Materials

The EU's carbon border adjustment mechanism (CBAM) has expanded its coverage to plastic products, imposing a tax of 96 euros per ton of carbon emissions.

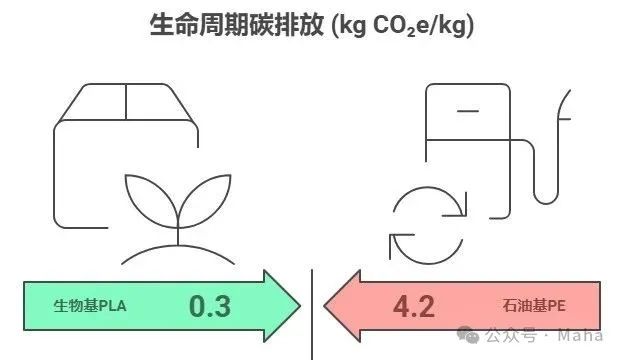

The carbon cost of traditional PE/PP plastics has increased by over 30%, while bio-based PLA has 70% lower carbon emissions.

Walmart, IKEA, and other giants have mandated that 30% of plastic packaging be bio-based by 2026.

The market space has fully opened up.

Global demand for biodegradable plastics is expected to exceed 5 million tons in 2025 (with an annual growth rate of 28.7%).

China's exports of bio-based materials increased by 61.2% in the first three quarters.

A trillion-dollar substitution market has formed (according to McKinsey's prediction, the global market size will reach 280 billion US dollars by 2030).

II. The Global Trade Tug-of-War for Two Key Materials

1. PLA (Polylactic Acid): The Golden Route in Corn Grains

Performance Advantages: Transparency comparable to PET, degradation cycle 6-12 months

Trade Landscape:

→ NatureWorks of the US holds 45% of global production capacity (new base in Thailand has started production)

→ Fengyuan Group of China breaks the monopoly of caprolactone technology and its production capacity ranks second globally

Cost Pain Points: Imported caprolactone costs 28,000 yuan/ton, after domestic production, it drops to 16,000 yuan

2. PBAT (Polybutylene Adipate-Trimethylene Caprolactate): The Main Force in Flexible Packaging

Application Scenarios: Plastic film, courier bags, food packaging

China Dominance: 68% of global production capacity is concentrated in China (leading companies are Goldschmidt Technology and Hengli Petrochemical)

Trade Shift: Southeast Asia becomes the largest export market (import volume in Vietnam has increased by 152%)

III. Key to Chinese Enterprises' Breakthrough: Technological Breakthrough to Rebuild the Trade Chain

1. Autonomy in Raw Materials Breaks the Lockdown Situation

Fengyuan Group has built a 50,000-ton/year caprolactone plant (the core raw material for PLA)

CNOOC Technology has produced diketone from corn straw, reducing the cost of PBAT by 18%

2. Overseas Capacity Layout Avoids Trade Barriers

Jinfa Technology's Vietnam base has started production of 100,000 tons/year modified bioplastics

Hengli Petrochemical has jointly built a 30,000-ton PBAT project in Indonesia (enjoying zero-tariff exports to the EU)

3. Technological Modification Breaks the Application Boundaries

Wanhua Chemical has developed biodegradable tableware resistant to 100°C (solving the heat resistance defect of PLA)

Blue Crystal Biophan materials have entered the medical aesthetics field (increasing the unit price of suture lines by 20 times)

IV. Key Points for the Next Three Years: Capacity Competition vs. Standard Game

Capacity Expansion Is Intensifying

There are over 70 ongoing biobased material projects globally, with China accounting for 53 of them

Capacity Overcapacity Warning for 2025: Planned PLA capacity is 1.8 times the actual demand

Standard Setting Rights Struggle

The EU plans to introduce mandatory certification of biobased content (possibly excluding non-ISCC system products)

China promotes the "International Standard for Biodegradable Plastics" to be included in the ISO system (draft has been submitted)

Industry Warning: A leading enterprise lost 200,000 tons of PLA orders due to not passing the German DIN certification, incurring losses of over 30 million yuan

Conclusion: A New Era of Green Trade Has Arrived

When BASF announced it would stop selling petroleum-based packaging plastics in 2030, and when Amazon replaced traditional PE film with biobased bubble bags, the material revolution is rapidly reconstructing the global chemical trade map. For Chinese enterprises, this is not only a 100-billion-yuan market for replacing traditional plastics, but also a historic opportunity to break the monopoly of high-end materials.

The next decade belongs to the "new species" that master the core technologies of biomanufacturing.