In Starbucks' coffee cups, the milk tea cups of tea houses, and the juice bottles on supermarket shelves, those seemingly insignificant straws are quietly triggering a storm concerning ecological health and industrial transformation. According to data from the United Nations Environment Programme, globally, over 500 billion single-use straws are consumed each year. If they were connected end to end, their length would be sufficient to circle the Earth's equator 1,300 times. This trillion-dollar tiny market, driven by the dual forces of plastic restriction and environmental protection demands, is undergoing an unprecedented material iteration and industrial reconfiguration.

Plastic Straws: The Neglected "White Killer" in the Ecological Chain

Traditional plastic straws are mainly made of polypropylene (PP), a synthetic material derived from petroleum cracking. With advantages such as low cost of individual units at 0.01 yuan and mature molding processes, it has long occupied over 90% of the global market share. However, behind the glamorous commercial data lies an alarming ecological cost!

According to a study by Nature magazine, each plastic straw takes 450 years to completely degrade in the ocean. Meanwhile, approximately 8 million tons of plastic waste flow into the ocean globally each year, with straws accounting for as much as 15%. Even more严峻ly, plastic straws have formed a complete "pollution loop" - the production process consumes fossil energy, and after use, they become white waste. During decomposition, microplastics released can return to the human body through the food chain.

Research by the University of Georgia in the United States confirmed that each plastic straw used more than 3 times would produce over 100,000 microplastic particles on its surface. These particles, with a diameter of less than 5 millimeters, can adsorb carcinogens such as polychlorinated biphenyls and enter the human body through beverages, potentially causing inflammatory reactions and hormonal disorders. Data from the Chinese Center for Disease Control and Prevention in 2024 showed that the blood samples of people who frequently use plastic straws had a microplastic detection rate of up to 78%, showing an upward trend compared to 2023. This "from cradle to grave" pollution chain has forced the world to initiate a revolution in straw material.

The Iteration Crisis in Material Evolution under Policy Storms

In 2020, China implemented the "strictest plastic restriction order in history", clearly requiring the catering industry across the country to ban non-degradable plastic straws by 2021. 60+ countries and regions around the world simultaneously introduced similar bans, directly causing the market size of plastic straws to drop from 2.8 billion US dollars in 2019 to 1.2 billion US dollars in 2023, and further shrinking to less than 1 billion US dollars in 2024, with various biodegradable straws quickly seizing the market share. Under the pressure of policy, the industry embarked on a frantic exploration of alternative materials, but each attempt was fraught with challenges.

Paper Straws: A Disaster of Consumer Experience under the Name of Environmentalism

Paper straws, with the advantage of natural decomposition within 1 - 3 months, quickly occupied 40% of the market share initially. However, consumers voted with their feet and gave a harsh answer: A survey by the British Consumer Council showed that 78% of respondents refused to purchase beverages using paper straws because of "softening easily, poor taste, and inability to suck pearls".

Even more ironically, producing 1 ton of paper straws requires the consumption of 17 trees, and the chemical wastewater generated during the pulping process pollutes the environment, greatly reducing the environmental benefits. A leading tea-drinking brand's internal data for 2024 showed that the complaint rate caused by paper straws was 250% higher than that of plastic straws. With the rise of polylactic acid straws, the market share of paper straws had dropped below 10% in 2024.

Plant Straws: The Reality of Idealism

Plant straws, made from raw materials such as straw and wheat stalks, can achieve 100% biodegradation. However, their insufficient hardness leads to problems such as easy breakage and poor heat resistance (deforming above 40℃). They are only limitedly applied in tropical regions such as Southeast Asia. A trial data from a leading tea-drinking brand showed that the complaint rate caused by the breakage of plant straws was three times higher than that of plastic straws. In addition, the production of these straws relies on agricultural raw materials, with supply stability and strong seasonality as industry shortcomings. According to a 2024 report by a market research institution, plant straws account for less than 5% of the global straw market and have always been difficult to become the mainstream.

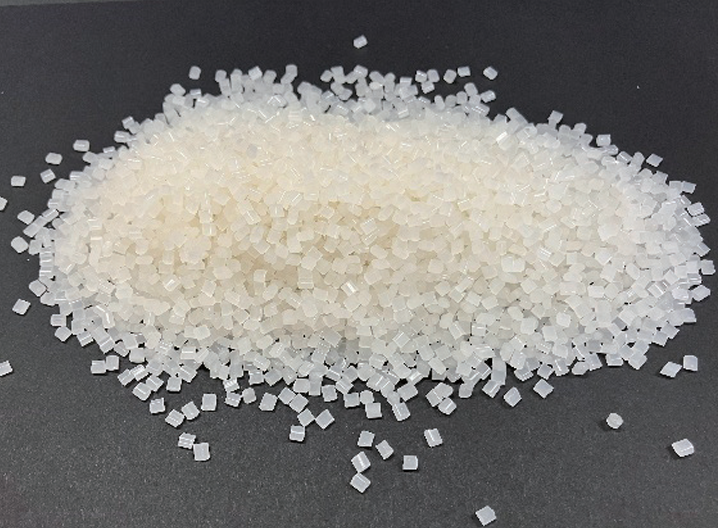

Polylactic Acid Straws: A Perfect Solution Born from Technological Breakthrough

The emergence of polylactic acid (PLA) material completely broke the industry's curse that "environmentalism and experience cannot be achieved simultaneously". This biodegradable polyester, synthesized from crops such as corn and cassava through microbial fermentation, has a degradation rate of over 95% under 180-day composting conditions. The carbon emissions during the production process are 68% lower than traditional plastics. More importantly, through modification technology, polylactic acid straws can be used in a wide temperature range of -10℃ to 70℃, with more than 3000 times of bending resistance, fully meeting the needs of beverage consumption scenarios.

Market explosion driven by industrial chain collaboration

Under the dual drive of policies and technology, the polylactic acid straw industry has shown an exponential growth trend:

Production end: The 2024 annual report of the global straw leader, Shuangtong Straw, shows that the production capacity of polylactic acid products has increased from 5,000 tons in 2020 to 40,000 tons in 2024, with a 45% increase in sales revenue and a 18% increase in gross profit compared to traditional products. Another national-level green factory, Ningbo Changya New Materials Technology Co., Ltd., whose polylactic acid series products have been selected for the green design product list by the Ministry of Industry and Information Technology, achieved sales exceeding 1.2 billion yuan in 2024, with partners including Haidiluo, Meixue Bingcheng, KFC, Walmart, and other well-known domestic and international brands, with over 95% of the products sold to 200+ countries and regions around the world.

Consumer end: The 2024 annual report of Meixue Bingcheng shows that after using polylactic acid straws, the complaint rate decreased by 85%, and consumer satisfaction increased to 93%. Luljin Coffee's 2024 purchase volume of polylactic acid straws reached 350 million pieces, a 25% increase compared to the previous year, and it plans to further expand the usage ratio in 2025.

Technology end: Jinfa Technology's reinforced polylactic acid material has lowered the low-temperature brittleness temperature of the straws to -20℃. Starbucks' "Chopstick Tube" uses a combination process of extracting coffee powder and polylactic acid, and can complete degradation of 90% within 4 months, which is higher than the 6-month standard required by domestic and international regulations, and the user experience has significantly improved. After being widely promoted in 2024, it has received widespread praise from consumers.

Unfinished battle in the trillion-dollar market

Although polylactic acid straws have occupied 75% of the market share of degradable straws, the industry still faces three core challenges:

Cost barrier: The price of polylactic acid raw materials is 3 - 5 times that of polypropylene. Although the continuous breakthroughs in domestic polylactic acid technology have reduced the industry average cost from 40,000 yuan/ton in 2019 to 21,000 yuan/ton in 2024, further cost reduction through large-scale production and technological innovation is still needed. According to statistics, due to cost issues, polylactic acid straws are 2 - 3 times more expensive than plastic straws, limiting their popularity in the price-sensitive low-end market.

Cognitive blind spot: In 2024 market research, 40% of consumers could not distinguish between polylactic acid and traditional plastic straws, and had insufficient knowledge of the environmental advantages and usage methods of polylactic acid straws. Some consumers were concerned about the safety of polylactic acid straws, and even had the misunderstanding that "degradable straws are of lower quality than plastic straws", urgently needing enhanced popularization education.

Application expansion: In the dairy packaging field, Mengniu Dairy's 2025 annual public sourcing announcement for straw materials shows that the target material is still plastic straws (material PP). Other dairy enterprises have not yet fully switched to polylactic acid straws in their usage, which reflects the complexity of industry transformation and indicates the potential for a trillion-dollar incremental market space. Currently, the global dairy industry consumes over 100 billion straws annually, if all are replaced with polylactic acid straws, it will bring huge market opportunities.

Industry forecasts show that by 2031, the global PLA straw machine market sales are expected to reach 4.07 billion yuan, with a compound annual growth rate (CAGR) of 5.7% (2025 - 2031), and the market size of polylactic acid straws in China will also experience rapid growth. With continuous technological progress, reducing the synthesis cost of polylactic acid, and 3D printing technology enabling personalized customization production of straws, polylactic acid straws are expected to further expand the market. In the future, polylactic acid straws will also have greater development potential in aviation catering, household daily use, and other fields. As people's environmental awareness improves, their market demand will continue to rise. This material revolution starting from beverage cups is gradually rewriting the development map of the entire biobased material industry through collaborative innovation in the industrial chain.