Under the strategic backdrop where major global economies are competing to develop the bioeconomy, China has made remarkable progress in basic research in the field of bio-manufacturing. The number of scientific research papers and core technology patents in this field ranks among the top in the world. However, a core bottleneck restricting the development of the industry is becoming increasingly prominent. The efficiency of converting cutting-edge scientific and technological achievements into real productive forces is insufficient. A large number of potential technological achievements remain at the laboratory stage and are unable to cross the industrialization gap from technological innovation to commercial success. The core lies in the advanced nature and maturity of the technology, which is only an initial condition rather than a sufficient one for industrialization. The true value of scientific and technological achievements must be realized through large-scale verification in specific industrial scenarios, economic assessment, and continuous iteration. Therefore, this report will focus on the key环节of the implementation of biotechnology scenarios, systematically analyzing the current application status and industrialization bottlenecks of biomanufacturing technologies in the fields of medicine, chemicals, and agriculture. The core objective is to explore how to build an efficient and collaborative technology transfer ecosystem, precisely打通 the complete chain from research and development to application, and effectively solve the value of biomanufacturing, thereby providing a practical path for our country to cultivate new quality productive forces in biomanufacturing.

I. Background of the Bioeconomy and Its Strategic Value

The global competitive landscape of biomanufacturing

The biomanufacturing industry, as one of the most promising strategic emerging industries in the 21st century, is currently triggering an industrial revolution worldwide. This emerging industry utilizes living organisms or biological systems to convert renewable biomass into high-value chemicals, materials, and energy. It not only demonstrates significant economic value but also provides innovative solutions to address global environmental pollution and resource shortage issues. According to statistics, currently, more than 60 countries and regions around the world have formulated strategic policies related to biomanufacturing or the bioeconomy. The Organization for Economic Cooperation and Development (OECD) predicts that by 2030, 35% of chemicals and other industrial products worldwide will come from biomanufacturing. The following will analyze the global biomanufacturing competition landscape from the perspectives of the United States, the European Union, Japan, and South Korea.

(1) The United States

The innovative-driven industrial ecosystem The United States leads globally in basic research, technological innovation, and industrial ecosystem construction. Relying on clusters such as Boston-Cambridge and San Francisco Bay Area, a "industry-university-research" deep collaboration system has been formed. Strong government support: In July 2024, 504 million US dollars was invested to build 12 "technology centers"; on November 19 of the same year, the Biden-Harris administration released a latest report titled "Establishing a Dynamic Domestic Biomanufacturing Ecosystem", aiming to promote biotechnology and biomanufacturing as part of the broader national biobusiness implementation plan.

(2) The European Union

The EU has adopted a development strategy of "top-level design + systematic promotion", formulating the "Vision Plan for Industrial Biotechnology 2025", and setting ambitious goals of achieving a 10%-20% substitution of traditional chemicals with bio-based chemicals by 2025, and increasing the proportion of renewable raw materials to 30% by 2030. Through funding mechanisms such as the "Horizon Europe" program, the EU has supported a large number of biomanufacturing projects, especially making significant progress in the application of synthetic biotechnology in energy and climate solutions. The EU has also established a network of pilot facilities covering the entire Europe, effectively promoting the industrialization of technologies. In March 2024, the European Commission released the "Strategy for Promoting Biotechnology and Biomanufacturing"; in January 2025, the newly established Biotechnology and Biomanufacturing Center provided important support for the innovation of small and medium-sized enterprises.

(3) Japan and South Korea

The Japanese government has set a goal of achieving a 100 trillion yen market size for the bioeconomy by 2030 through policy documents such as "Biological Strategy 2020". Japan has traditional advantages in the field of fermentation engineering, with global leading production volumes of amino acids and enzyme preparations. At the same time, companies like Meiji Holdings are actively laying out in emerging food sectors such as cell-cultured meat and microbial protein. The "Biological Manufacturing Revolution Promotion Plan" released in 2023 focuses on promoting microbial improvement and the application of digital technologies. South Korea has chosen synthetic biology as a breakthrough point, and the "Synthetic Biology Promotion Law" passed in April 2024 is the world's first specialized legislation. The passage of this law will promote the construction of a national-level "Biological Foundry Factory" with a total investment of 126.3 billion won. This facility, drawing on the model of semiconductor wafer factories, uses AI technology to achieve full-process automation of the design, construction, and testing of biological components, reducing the development cycle of biological components by 80%. South Korea aims to become one of the top five technological powers globally by 2030.

2. The international standing and development status of China in the field of bio-manufacturing

Although the biomanufacturing industry in our country started relatively late, it has shown a strong development momentum. The state has attached great importance to it. The release of policies such as the "14th Five-Year Plan for the Development of the Biotechnology Economy" has provided strong guarantees for the industry's development. In recent years, with the strong support of policies, China's synthetic biomanufacturing industry has also made rapid progress and development. A number of synthetic biology start-up enterprises in the country have developed rapidly. The technological upgrading of traditional products such as amino acids and vitamins has been continuously advanced, and in some important products, patent blockades can be partially bypassed. In the development of new products, foreign countries have technologies for the biomanufacturing of a series of important bulk chemicals such as long-chain alcohols, 1,4 butanediol, and phthalic acid, while Chinese scientists have achieved world-leading achievements in the biomanufacturing technologies of compounds such as inositol 3-hydroxypropionic acid and adipic acid. In the research directions of the most cutting-edge and determining the future industrial layout, such as new enzyme design and new synthetic pathway design, we have maintained parallelism with international levels. Compared with the advanced international level, there are still significant gaps in the biomanufacturing industry in our country. The core industrial added value only accounts for 2.4% of the industrial added value, which is much lower than 11% in the United States, 6.2% in the European Union, and 3.2% in Japan. In terms of industrial structure, the self-sufficiency rate of high-end raw materials and equipment is insufficient, and key materials such as industrial core strains still rely on imports. This reflects the shortcomings of our country in basic research and core technologies.

The latest statistics show that the total scale of China's biomanufacturing industry has reached nearly 1 trillion yuan. The fermentation production capacity accounts for over 70% of the world's total. A number of competitive biomanufacturing clusters have emerged.

Behind the industrial scale and production capacity advantages lies the continuous drive of technological innovation. In the past five years, the cumulative number of patent applications and authorizations by major biomanufacturing enterprises in China has reached 13,680 and 9,447 respectively, accounting for 52.2% and 63.8% of the historical total. The pace of technological innovation has significantly accelerated. Currently, China's biomanufacturing industry has achieved global leadership in some emerging fields. Since 2025, China has introduced a series of biomanufacturing industry policies, forming a support system covering the entire chain of research and development, manufacturing, and application. In Shenzhen, the country's first special regulation for synthetic biology industries has been implemented, establishing a cross-border clinical trial collaboration network, and accelerating the transformation of achievements. In Beijing, it is proposed to build a global innovation hub for synthetic biomanufacturing, with a focus on supporting the layout of high-value-added products. In Guangzhou, it focuses on specialized fields such as cell and gene therapy, recombinant proteins, etc., with the goal of forming a cluster of over 100 billion yuan in 2027.

The policy support has been continuously strengthened. In the 2025 government work report, biomanufacturing was listed as a future industry for the first time. The Ministry of Industry and Information Technology and other seven departments issued the "Implementation Opinions on Promoting the Innovation Development of Future Industries", clearly emphasizing the key promotion of its development. The Ministry of Industry and Information Technology also helped with industrial innovation through measures such as selecting and releasing typical cases of the application of artificial intelligence in the field of biomanufacturing. The application fields have also continued to expand, covering a wide range of industries such as biomedicine, bioceramics, bioenergy, and modern agriculture. In the field of biomedicine alone, the National Medical Products Administration approved 93 new drugs in 2024, reaching a new high in the past five years. The number of drugs under research in China also ranks second globally. The economy has shifted from a stage of high-speed growth to a stage of high-quality development. Taking biomanufacturing as an important development direction fully embodies the requirements of the new development concepts, responds to the growing need of the people in the new era for a beautiful ecological environment, better coordinates economic and social development with environmental protection, and accelerates the green transformation of traditional manufacturing industries.

3. Strategic Value

Biological manufacturing, as a disruptive paradigm that integrates biotechnology and advanced manufacturing, has the potential to solve the problems faced by traditional industries, achieve the "dual carbon" goals, ensure national strategic security, and cultivate new quality productive forces. However, China's manufacturing industry has long relied on traditional methods such as petrochemicals, facing issues such as high resource dependence and high carbon emission intensity. Biological manufacturing, with its advantages of renewable raw materials and green processes, can restructure the logic of material production. Its bio-based products can reduce emissions by an average of 50%-70% compared to the petrochemical route. If a 30% substitution rate can be achieved in the chemical and materials sectors by 2030, cumulative carbon dioxide emissions can be reduced by over 1.5 billion tons. Currently, the global competition in the bioeconomy is intense, with the United States and Europe controlling the leading position of the industrial chain through special plans. Developing biological manufacturing is not only necessary to respond to competition and ensure the security of supply in key fields, but also an inevitable choice to cultivate a new growth engine by leveraging the core industrial scale of over 800 billion yuan and over 70% of global fermentation production capacity.

(Biological manufacturing activates new driving forces for multiple industries)

Biological manufacturing technology, with its significant advantages such as renewable raw materials, green processes, and designable products, is playing an irreplaceable role in key sectors of the national economy including energy, chemical industry, food, and medicine. It has become the core path to solve the structural contradictions of traditional manufacturing, such as high resource dependence, high carbon emission intensity, and lagging technological iteration. Currently, the manufacturing methods of products profoundly affect the quality of national economic development. However, in many key manufacturing fields in China, traditional preparation methods like petrochemicals, organic synthesis, and plant extraction are still dominant. These technologies not only have high difficulty in upgrading and replacing but also struggle to adapt to the rapid changes in market demands and the competition from emerging technologies.

Taking the biodegradable material monomer diacid as an example, the domestic output value of this category reached 700 million yuan in 2023. However, its production has so far been highly dependent on chemical catalytic oxidation technology. During the process, a large amount of waste gas, wastewater and solid waste are produced, which not only consume a lot of energy but also cause severe pollution. The transformation and upgrading of the manufacturing method is urgently needed. The same bottleneck also exists in the alternative protein field of the food industry. China's self-sufficiency rate of soybeans is less than 15%, and it needs to import 100 million tons of soybeans each year. This amounts to occupying 761 million mu of arable land, accounting for 43.3% of the total national grain sown area. The development of the alternative protein industry is severely restricted by the scale of soybean imports. However, through the application of microbial protein synthesis technology on a large scale, it can replace the traditional planting mode and build a "non-land-dependent" protein supply chain, fundamentally breaking this resource constraint situation. In the long run, biomanufacturing is not only an important support for leading China's modern industrial system construction through technological innovation, but also a key force that gives birth to new industries, new models and new driving forces, injecting strong impetus into the development of new quality productive forces, and will continuously promote the transformation of China's manufacturing industry towards greening, efficiency, and sustainability.

(2) Biomanufacturing strengthens the foundation for achieving the "carbon neutrality" goal

The low-carbon characteristics of bio-manufacturing are highly prominent and have become an important driving force for China to achieve the "dual carbon" goals. Currently, the total annual carbon emissions of China's petrochemical and coal chemical industries are close to 900 million tons, accounting for approximately 23% of the total industrial emissions. These industries are key areas for emission reduction in the industrial sector. Bio-manufacturing, relying on the full life-cycle negative carbon advantages of "utilizing renewable carbon sources - designing low-carbon processes - achieving product carbon sequestration", provides a key path for achieving carbon neutrality. Relevant data calculations show that compared with traditional petrochemical production routes, the carbon emissions of bio-based products can be reduced by an average of 50% to 70%. Based on this emission reduction efficiency, if bio-based products can replace 30% of traditional petrochemical products in the chemical and materials sectors, then by 2030, the cumulative reduction in carbon dioxide emissions will exceed 1.5 billion tons. In addition, bio-manufacturing also has more far-reaching strategic significance. It can directly convert carbon dioxide into products such as aviation fuel and high-end chemicals, thereby building a future new industrial manufacturing route and technology system. This breakthrough will drive the manufacturing industry to leap from the traditional "carbon consumption" model to a green and sustainable "carbon circulation" model, providing solid technical support for the final realization of China's "dual carbon" goals.

(3) International competition landscape and the struggle for interests within the industrial chain

Over the past few years, countries and regions around the world have reached a consensus: Biomanufacturing, although derived from the fermentation industry, goes far beyond the scope of traditional fermentation industries and is a new industrial form that deeply integrates traditional fermentation technologies with the cutting-edge achievements of synthetic biology. Its great potential in promoting the transformation and upgrading of the manufacturing industry, practicing the green and low-carbon development path, and facilitating the implementation of the bioeconomy has been widely recognized by the global industry and academic communities. All parties hold an optimistic attitude towards its application prospects. From an economic perspective, a study by McKinsey predicts that theoretically, 60% of products in the global market can be produced through biomanufacturing technology. The economic explosive power of this industry cannot be underestimated - in the next 10 to 20 years, its direct economic value is expected to reach 4 trillion US dollars; if the time frame is extended to the end of the 21st century, biomanufacturing is expected to contribute an economic scale of 30 trillion US dollars, accounting for one-third of the global manufacturing output value. Therefore, biomanufacturing has become a core area of global strategic competition, and developed countries such as the United States and Europe regard it as a key battlefield in the "21st-century economic sovereignty competition". Since 2022, the United States has taken the lead and has established a full-chain industrial system covering DNA synthesis, AI biological design, and biological manufacturing plants through signing the "National Biotechnology and Biomanufacturing Plan" executive order and releasing the "U.S. Biotechnology and Biomanufacturing Grand Goals" policy. The core goal is to fully control the dominant position of the entire industrial chain of biotechnology and biomanufacturing. The European Union relies on the "Horizon 2020" and "Horizon Europe" special research frameworks to systematically layout the biomanufacturing field; Germany has promoted the implementation of synthetic biological technology in industrial scenarios through the introduction of the "National Bioeconomy Strategy", and leading chemical enterprises such as BASF and Evonik have achieved remarkable results in the industrialization process of biomanufacturing technology. Currently, the competition pattern in the global field of synthetic biology and biomanufacturing has basically taken shape. From the perspective of China, although it has certain advantages in downstream industry layout and application ecosystem construction, there are still shortcomings in core technologies in the upstream field, and key links such as gene editing tools and key databases still rely on external sources, facing risks. It can be said that the level of innovation and development of biomanufacturing directly determines whether China can seize the initiative and hold the initiative in the new round of global industrial transformation, and then achieve breakthroughs on this new track.

However, the implementation of this scenario still faces several core contradictions. Firstly, there is a lack of synergy between core technologies and the industrial chain. Secondly, the efficiency of innovation transformation is low, and the supporting system is lagging behind. The process of成果转化 is long and costly, there is a shortage of pilot testing platforms, the supply of high-quality data and algorithm models is limited, the standard system does not closely connect with international standards, and thirdly, the connection between policy support and market mechanisms is not tight. Financial investment mainly focuses on research and development, and there is insufficient support for pilot testing and market cultivation. To solve these core contradictions, China can build an independent and controllable industrial chain to ensure strategic security, lead the formulation of international standards to enhance global discourse power, accelerate the realization of the "dual carbon" goals and promote green transformation; promote the industry to upgrade from traditional fermentation to coupling with new technologies, restructure the competitive landscape in the fields of chemicals and materials; mastering core technologies can break through international barriers and form differentiated advantages. Relying on a complete supporting system, the product launch cycle can be shortened and costs can be reduced. By leveraging the designability of products, one can seize opportunities in emerging fields.

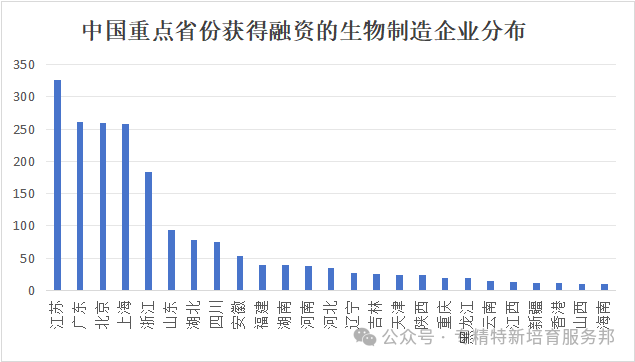

Figure 1 Distribution of biomanufacturing enterprises that have received financing in key provinces of China

Figure 1 Distribution of biomanufacturing enterprises that have received financing in key provinces of China

III. Analysis of the Current Application Status and Industrialization Bottlenecks of Biomanufacturing Technology

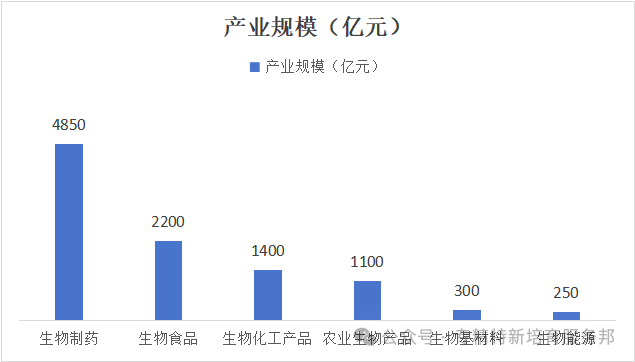

In 2024, the three leading sub-sectors in China's biomanufacturing industry by scale are biopharmaceuticals, biobased foods, and biobased chemical products. Among them, biopharmaceuticals remain the largest sub-sector in this industry; biobased foods, biobased chemical products, and agricultural biological products form the second tier of the industry's scale, with their scale proportions remaining relatively stable; the industrial scale of biobased materials and bioenergy is relatively limited and is in the third tier, with considerable potential for development in the future (see Figure 2).

Figure 2: Structure of China's Biomanufacturing Industry in 2024

Figure 2: Structure of China's Biomanufacturing Industry in 2024

1. Analysis of Current Application Status

The deep integration of emerging technologies such as artificial intelligence, big data, machine learning, and synthetic biology with synthetic biology will further enhance the efficiency and accuracy of biological manufacturing, and develop more innovative and high-value-added products. Industrial cooperation will become closer and more in-depth. Cooperation among enterprises, among academia, industry and research, as well as between domestic and foreign enterprises will continue to strengthen, forming a more complete industrial ecosystem. Through resource sharing and complementary advantages, all parties will jointly promote the innovation and application of biological manufacturing technology, accelerating the development of the industry. The government will also continue to play an important guiding and supporting role, introduce more favorable policies, increase investment in the biological manufacturing industry, and create a favorable policy and market environment for industrial development.

(1) Listed companies and innovative enterprises are working together hand in hand.

In the booming wave of the biomanufacturing industry, the cooperation between listed companies and innovative enterprises has become an important force driving the progress of the industry. This cooperation model, through means such as equity investment, mergers and acquisitions, and industrial synergy, has achieved complementary advantages in resources, technology, and market for both parties, opening up new paths for the technological transformation and commercialization in the field of biomanufacturing. Many listed companies and industrial groups, such as Guizhou Moutai, Huaxi Biotechnology, and Aimei, have keenly recognized the huge potential of the biomanufacturing industry and actively engaged in cooperation with innovative enterprises. Innovative enterprises usually focus on technology-driven strategies and have unique advantages in research and development, but may have deficiencies in production, sales, and brand building. On the other hand, listed companies possess mature production systems, extensive sales networks, and strong brand influence. After the cooperation, innovative enterprises can leverage the resources of listed companies to quickly bring their technologies to the market and realize commercial value; listed companies, through investment, mergers and acquisitions, or business cooperation, can layout in the biomanufacturing field, seek new growth drivers for their own development, and expand their business scope.

Take Guizhou Moutai Group as an example. In recent years, it has been actively moving forward and making strategic arrangements in the field of bio-manufacturing. In 2023, Moutai Group established two large-scale CVCs, demonstrating its strategic determination in the field of bio-manufacturing. In October 2024, Moutai Group established a new investment fund with He Shi Eye Hospital, focusing on investing in new-generation medical health, dietary nutrition, and synthetic biology fields. Over the past two years, Moutai has successively invested in synthetic biology innovation enterprises such as Taihe Weiye, Xing Sai Biology, and Hongmo Biology. Through these investments, Moutai Group, on the one hand, has vertically laid out the industrial chain, deeply exploring the application of bio-manufacturing technology in the production of liquor, such as the research on brewing microorganisms, in order to improve the quality and production efficiency of liquor; on the other hand, through cross-industry horizontal layout, it has expanded into medical health, nutritional food and other fields, seeking diversified development, and continuously promoting industrial upgrading, achieving the deep integration of traditional industries and emerging technologies.

(2) Innovation-driven empowerment, activating traditional fermentation

As a major global producer of fermentation, China holds a pivotal position in the field of biological fermentation, with approximately 70% of the global fermentation capacity. In 2024, the Chinese bio-fermentation industry demonstrated a vast industrial scale, with the output of main products reaching nearly 34 million tons and the product value approaching 290 billion RMB. In terms of product structure, bulk products such as amino acids and organic acids dominated the production capacity, accounting for approximately 60%, but the proportion of high-value-added products was relatively low, less than 15%.

In the field of soybean meal fermentation, the inventory levels in some regions have reached record highs, resulting in intense market competition and frequent price wars, which have severely reduced the profit margins of enterprises. Due to the influence of market热度, many fermentation production lines lacked sufficient market demand research and scientific assessment during their initial construction, leading to increasingly prominent overcapacity issues and low actual utilization rates. In 2024, the capacity utilization rate of China's规模以上 industrial enterprises was 75.1%. In mature fermentation fields such as food and feed, the idle rate of fermentation capacity in these competitive sectors may exceed 30%. However, in emerging fields such as new protein and new sweeteners, the idle rate of production capacity is relatively low, and some projects are even operating close to full capacity.

In contrast, platform-type and innovative enterprises have significant advantages in terms of R&D investment and technological strength. These enterprises usually allocate a large amount of resources to R&D, constantly exploring and developing new technologies and processes to enhance their core competitiveness. Innovative enterprises can bring new vitality and opportunities to the traditional fermentation industry by collaborating with mature fermentation enterprises. In terms of improving production efficiency, innovative enterprises can utilize advanced biotechnologies and engineering optimization methods to improve the control and management of the fermentation process, increase fermentation efficiency, shorten production cycles, and thereby reduce production costs. In terms of enhancing product value, innovative enterprises can develop products with higher performance and quality through research and application of new technologies, meeting the market's demand for high-end and personalized products, and opening up new market spaces for mature fermentation enterprises.

The acquisition of Shandong Weizhi Biotechnology by Enhe Bio in 2023 is a typical success story. As an innovative enterprise with leading technological advantages in the field of synthetic biology, after completing the acquisition of Shandong Weizhi Biotechnology, Enhe Bio fully utilized its technical expertise to comprehensively optimize and upgrade the production process of Weizhi Biotechnology. In terms of capacity improvement, Enhe Bio introduced advanced fermentation technologies and optimized production processes, which significantly increased the production capacity of Weizhi Biotechnology, achieving a doubling of output, with an estimated annual output value of 200 million yuan. In terms of product quality improvement, Enhe Bio utilized its technology in synthetic biology to finely adjust the production process of the products, improving the purity and stability of the products, and enhancing their competitiveness in the market. Enhe Bio also leveraged its research and development capabilities to enrich the product line of Weizhi Biotechnology and developed more new products with market potential, meeting the needs of different customers. Enhe Bio also expanded the international market for Weizhi Biotechnology with its international perspective and resources, enhancing its global market reputation and influence.

(3) Mutual assistance, global industrial collaboration

In the context of the accelerated integration of the global biomanufacturing industry, synthetic biology technology, due to its "infrastructure" attribute, demonstrates extensive application value across industries and regions. With the increasingly restructured global supply chain and the development of the decentralized trend, China's role in the global industrial landscape has undergone profound changes. It is no longer merely an assembly manufacturing country but actively participates in the global industrial collaboration process. The "two-way pursuit" of Chinese enterprises' product exports and overseas enterprises' layout in China has become an inevitable trend for the development of the biomanufacturing industry.

This trend is determined by the supply and demand structure of the global biomanufacturing industry. Chinese enterprises have accumulated strong engineering scaling capabilities and abundant low-cost raw material resources in the field of biomanufacturing. At the same time, they are eager to establish an international certification system through cooperation with overseas leading enterprises, enhance their brand influence in the global market, and thus open up the international market. Meanwhile, overseas enterprises value these advantages of China and hope to leverage China's capabilities and resources to optimize their production layout, reduce production costs, and improve product competitiveness. Cooperative forms such as joint ventures and cross-investment will become increasingly common. Cross-border joint development models, where Chinese enterprises provide process packages and overseas brands are responsible for application development, are expected to become a new trend in international cooperation in the biomanufacturing field.

In 2023, Rhenus Biotech signed a significant five-year business contract with DSM-Fineima. The two parties engaged in in-depth cooperation in the supply of natural products and technical collaboration, particularly in the fields of natural sweeteners and plant extracts. Rhenus Biotech, leveraging DSM-Fineima's extensive market and channel resources in the global nutrition, flavoring and health products sectors, successfully expanded its products from the Chinese domestic market to the global market, significantly enhancing its international influence. Meanwhile, DSM-Fineima, through its cooperation with Rhenus Biotech, was able to better achieve local production and layout in China, taking advantage of China's resource advantages to reduce production costs and improve the market adaptability of its products.

The successful implementation of these cooperation models has not only accelerated the rapid transformation and commercial application of biomanufacturing technology, but also provided new paths and directions for the transformation and upgrading of traditional industries. The cooperation between listed companies and innovative enterprises has accelerated the connection between technology and the market, promoting the diversified development of the industry; the empowerment of traditional fermentation industries by innovative enterprises has enhanced the production efficiency and product value-added of the industry, and strengthened its competitiveness; the international cooperation between Chinese enterprises and overseas enterprises has promoted the coordinated development of the global biomanufacturing industry, and constructed a more open and mutually beneficial international cooperation pattern.

2. Analysis of Industrialization Bottlenecks

(1) It is difficult to balance the commercial feasibility.

Although the technologies such as gene editing, strain modification and enzyme engineering in the laboratory stage of synthetic biology have become relatively mature, during the process of process scaling-up from pilot-scale to pilot-scale production and then to large-scale production, many parameters are difficult to be optimized simultaneously. From a technical perspective, even if the laboratory strain yields meet the standards, the process parameters still need to be adjusted for several months or even years in the pilot-scale stage. According to statistics, the annual increase in patent applications in the global biomanufacturing field is 35%, but the actual conversion rate is only 17%. For example, although the biological synthesis technology of paclitaxel has been broken through, the industrialization still faces problems such as unstable enzyme activity and long fermentation cycle, making it difficult to replace the traditional plant extraction method. Overcoming process scaling-up and achieving continuous and stable commercial production is the dividing line for the competition in this field. Innovative enterprises will face the dilemma of intertwined cost issues and commercial feasibility caused by the instability of process scaling-up. Due to financial and technical limitations, innovative enterprises are forced to produce on a small scale, resulting in a high final unit cost that cannot match the price competitiveness of traditional chemical enterprises in the same products due to their scale advantages. This limits the penetration rate of downstream biological products and bio-based materials. The essence of the biomanufacturing industry is still "manufacturing", and the gap between its technology and demand is essentially a conflict between the feasibility of laboratory technology and the production capacity for large-scale production. Solving this contradiction requires not only top-level policy guidance, but also promoting the construction of applied disciplines and cultivating interdisciplinary professional talents with the aim of "cost reduction and efficiency improvement".

(2) For innovative enterprises, establishing their own "moat" is an important way to cope with the market.

China is the world's largest producer of fermented products, with over 70% of the global fermentation capacity and abundant engineering resources. Some products, such as functional/modified amino acids, functional sugars, and cosmetic raw materials, face intense homogenization competition, with a large number of enterprises vying to establish their presence, resulting in frequent price wars. To seize the market, many enterprises choose to trade low prices for customers, sacrificing profit margins. Some enterprises in the industry have shown a situation where they "focus on increasing production capacity rather than technology, on lowering prices rather than value, and on raw materials rather than solutions". Taking collagen protein as an example, the rapid growth of the market has attracted many enterprises and capital to enter, including listed companies such as Jukong Biotechnology, Jinbo Biotechnology, and Huaxi Biotechnology, which have all increased their investment and layout in the collagen protein field. With the increase in market participants and the release of production capacity, the price competition for collagen protein products has become increasingly fierce. From 2021 to 2024, the price of recombinant collagen protein raw materials in China has experienced a significant decline. Public data shows that the cost price of type III recombinant collagen protein has dropped from 80,000 yuan/kg to 10,000 yuan/kg. Methionine is also a typical case of price competition. In the past three years, the price of methionine has plummeted from 200,000-300,000 yuan/kg to below 10,000 yuan/kg, a decline of nearly 3000%. Additionally, erythritol, vitamins, amino acids, hyaluronic acid, and other bio-based raw materials have also entered the "previously not wealthy but now competing for profits" stage.

The rapid expansion of Chinese biomanufacturing enterprises before achieving prosperity is mainly attributed to two factors: Firstly, the industry is still in its early stage, and most enterprises have not yet established mature technological barriers. Many innovative enterprises have not yet established a moat. To quickly enter the market, these enterprises can only rely on low-price strategies to obtain orders. Secondly, some enterprises fall into the trap of pursuing quick commercial returns. These enterprises tend to choose low-tech, short-cycle product tracks and avoid high-risk, high-investment original research and development. Moreover, domestic downstream customers have a high sensitivity to prices, and the market has not yet formed a consumption culture of purchasing high-quality or differentiated products, making it easier for enterprises to be drawn into the low-price competition track rather than the value competition track. In the face of this situation, establishing strong synergy with downstream customers becomes a feasible and important solution path. Through deep cooperation with downstream customers, enterprises can not only align product selection with actual application needs in the initial stage, but also form a stable business loop through customized development, joint research and development, and supply chain lock-in, thus breaking away from the situation of solely relying on price competition. Strongly binding downstream customers helps enterprises enhance their market bargaining power, stabilize cash flow, and provide solid support for continuous technological innovation and the layout of high-value-added products, thereby achieving the transformation from "competing on price" to "competing on value".

Rifen Biotechnology, a leading domestic enterprise in the field of natural nutritional component bio-manufacturing, integrates its natural sweeteners and natural nutritional component products through the concept of "large-scale compounding" to provide new formulation and ingredient solutions for downstream B-end customers. Based on natural sweeteners, Rifen Biotechnology offers sugar compounding solutions with various sugar ratios to customers, while also leveraging its own production capabilities of natural nutritional components and flavor blending to offer customers a wider range of flavors and more diverse formulation possibilities. Taking the cooperation between Rifen Biotechnology and YG Forest as an example, it has transformed from a pure raw material supplier to a partner for YG Forest. Together with YG Forest, it has developed a new product, "Red Bean and Coix Seed Water", providing YG Forest with natural sugar solutions while also supplying YG Forest with red bean and coix seed extracts and related flavors, helping to create new product formulations. Rifen Biotechnology relies on its channels with global market brand-end customers to provide high-value-added solution services, maintaining stable profitability and the sustainable iterative capability of technical products.

IV. Exploration of the Critical Path

1. First stage: A new synthetic biology industry system centered on pilot-scale production and industrial funds

Pilot production is a crucial link bridging laboratory-scale experiments and industrial-scale production. Its scale generally ranges from hundreds of liters to hundreds of tons, depending on the technical route and product characteristics. Its core tasks include verifying process feasibility, optimizing parameters, and assessing economic viability, laying the foundation for industrialization. However, for start-up enterprises, the construction of pilot production facilities has a high threshold. On one hand, investments in infrastructure such as fermentation tanks, purification equipment, and control systems are large, and operating costs are high; on the other hand, the operation of the platform requires high standards for scale-up processes, equipment management, and quality control, and the start-up teams have limited experience. Moreover, the construction period is long and the technical uncertainty is high, which can lead to waste of time and resources and slow down the commercialization process.

Currently, the pilot production capabilities in industrial clusters such as the Beijing-Tianjin-Hebei region, the Yangtze River Delta, and Shenzhen are relatively lagging behind. A large amount of innovative achievements are largely accumulated at the laboratory stage. Taking Shenzhen as an example, although over a hundred new biomanufacturing enterprises have been added in recent years, the construction of municipal pilot production platforms has been progressing slowly, and it has become a bottleneck for industrial development. Therefore, some local governments and companies with intentions to invest are accelerating the construction of regional comprehensive pilot production platforms to promote the implementation of innovations. At the enterprise level, leading enterprises promote the integration of upstream and downstream resources in the biopharmaceutical industry through merger and acquisition funds, and facilitate precise matching between pilot production platforms and market demands. For example, Huaxi Biotech's pilot production platform is compatible with food, medicine, and skin care product sectors, achieving comprehensive application in multiple fields. And local governments, in order to seize the high ground of emerging industries in the biomanufacturing sector, have also begun to actively build "pilot production expansion platforms" and set up corresponding special funds to provide infrastructure sharing + technology transformation support, significantly reducing the cost of early technology amplification trial errors and accelerating the implementation of scientific research results. The advantages of this collaborative mechanism are: